Solutions

Better Member Service Through Better Knowledge.

Transform member interactions and institutional knowledge into service workflows, compliance documentation, and experience improvements.

Credit Union Knowledge Challenges

Member Service Inconsistencies

Different staff members handle similar situations differently. Member experience varies by who they talk to, and best practices don’t spread across your team.

Compliance Documentation Burden

Regulatory requirements demand detailed documentation, but creating and maintaining compliance records takes time away from serving members.

Lost Institutional Knowledge

When experienced staff retire or move on, decades of member relationship insights and operational knowledge disappear, leaving gaps in service quality.

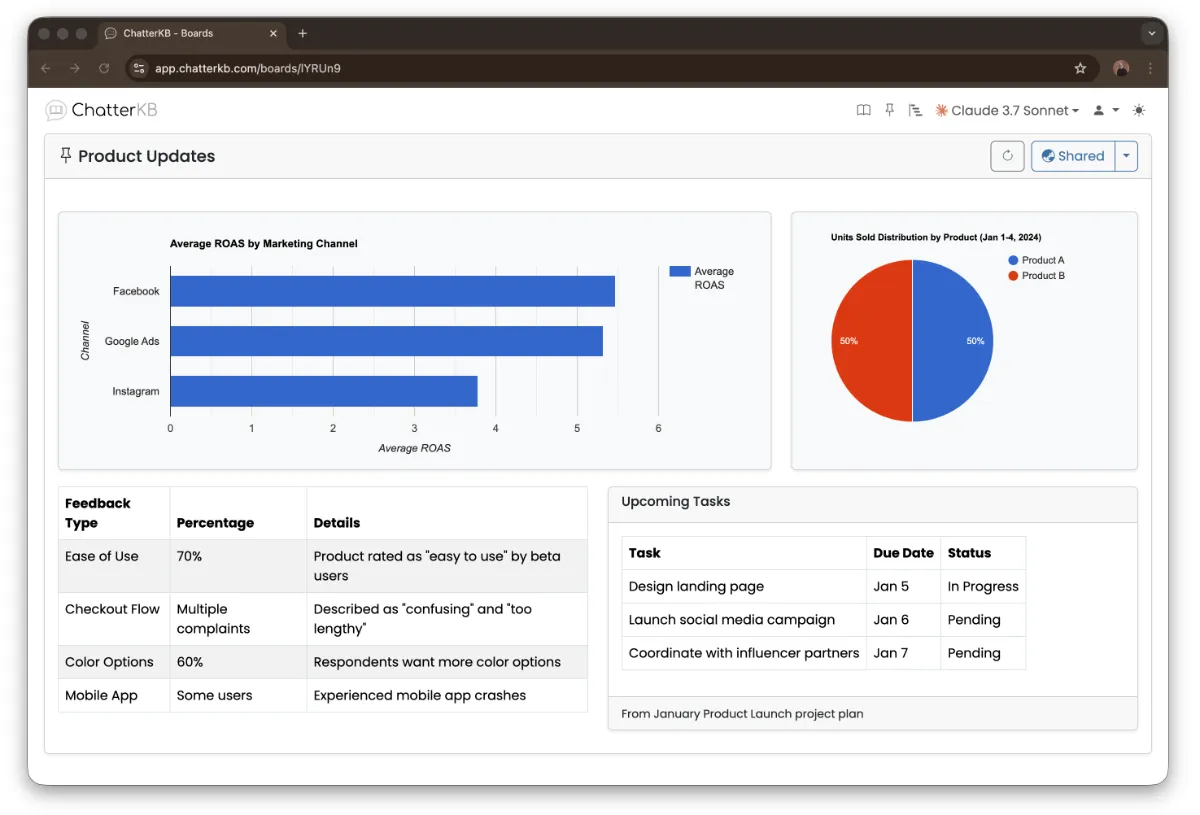

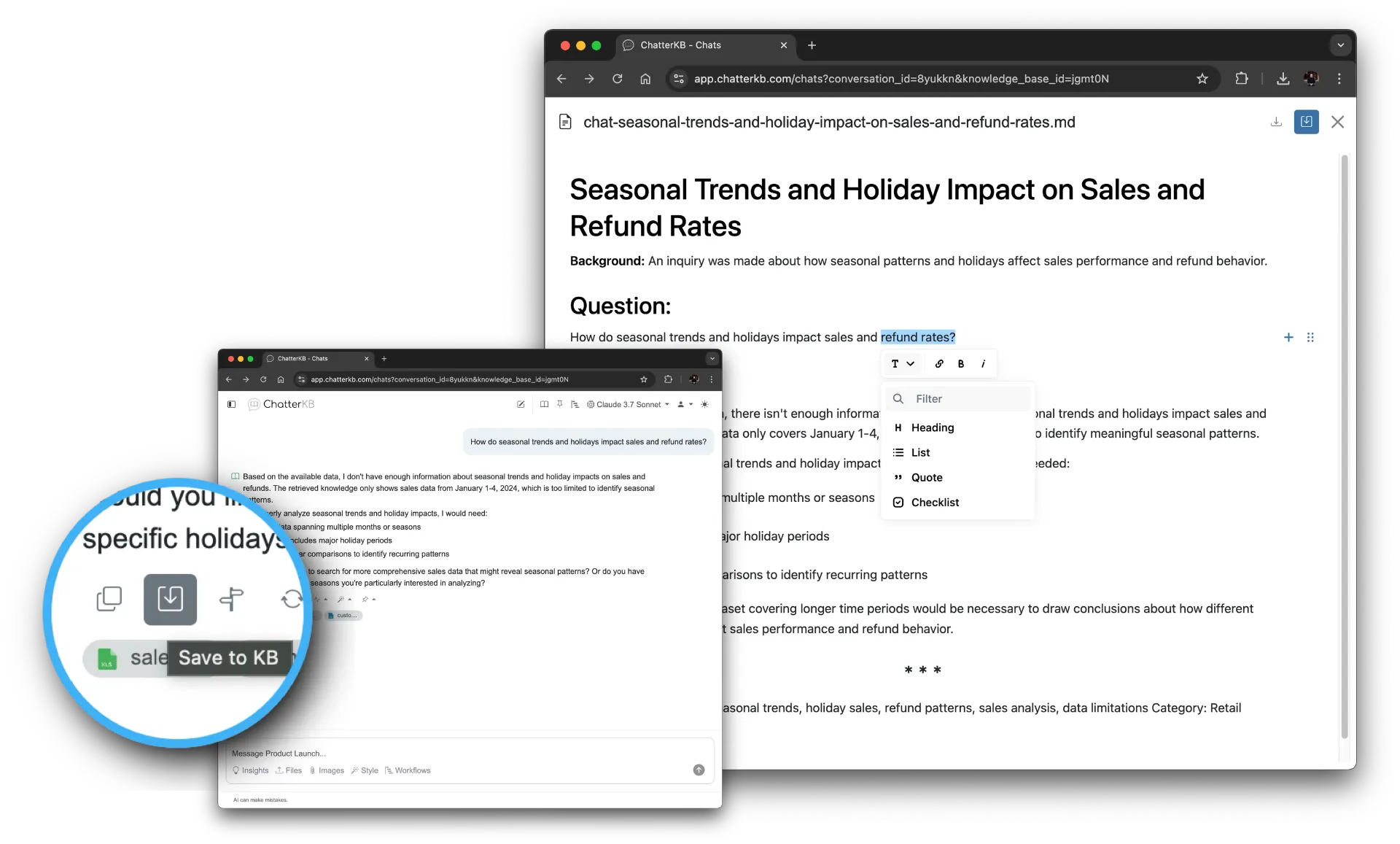

From Member Interactions to Institutional Intelligence

Capture, organize, and leverage member knowledge for consistent, compliant, and exceptional service.

Capture Member Interactions

Automatically collect insights from member conversations, service notes, and operational documentation.

Organize by Service Type

AI categorizes information by member needs, compliance requirements, and service workflows for easy access.

Generate Service Tools

Create member service guides, compliance reports, and training materials using your institutional knowledge.

Built for Member-Focused Financial Institutions

Capture • Standardize • Excel

Consistent Member Experience

Ensure every member receives the same high-quality service because teams share standardized knowledge, scripts, and decision trees.

Streamlined Compliance

Automatically generate compliance documentation and maintain regulatory records without manual overhead.

Faster Staff Training

New employees access institutional knowledge instantly. Reduce training time and improve service quality from day one.

Member Relationship Insights

Understand member needs better through organized interaction history and service pattern analysis that surface key opportunities.

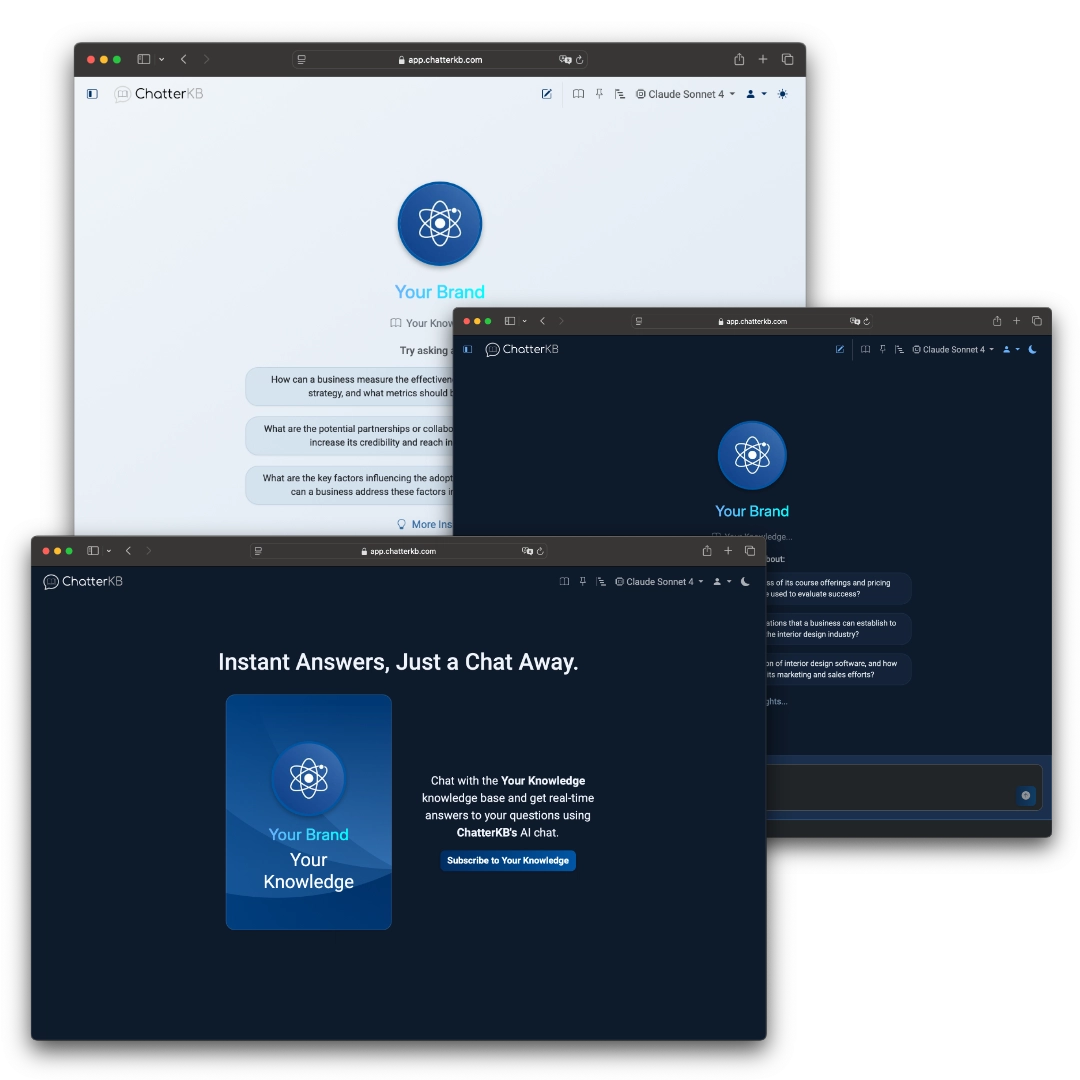

Turn Financial Expertise Into Member Trust

Create branded, public knowledge bases that showcase your expertise while building member confidence.

Custom Credit Union Branding

Add your credit union’s logo, colors, and custom CSS for complete brand control.

Member Trust & Education

Build member confidence through valuable financial insights and service expertise.

Financial Service Leadership

Position your credit union as the trusted authority in member-focused banking.

Member Self-Service Portal

Reduce member service load with intelligent, branded financial resources.

Enterprise-Grade Security Without the Enterprise Headaches

Deploy ChatterKB on your infrastructure with complete data sovereignty, regulatory compliance, and zero-trust security.

Client-Hosted Infrastructure

- Deploy on your own cloud with full data sovereignty

- Integrated secrets management with database host authentication

- Zero data leaves your environment—ever

Tenant-Isolated Architecture

- Separate schemas per branch or business unit

- Built-in migration tools for seamless transition to your infrastructure

- Scalable security that grows with your membership

English-to-Automation Intelligence

- Transform member service requirements into executable workflows

- Memory-centric execution that learns and adapts

- Timeline-based progress tracking without technical complexity

Built for Regulated Finance

- Enterprise-grade compliance architecture from day one

- Comprehensive audit trails and access controls

- Expert support for mission-critical financial operations

Ready to Enhance Member Service?

See how ChatterKB can help your credit union deliver consistent, compliant, and exceptional member experiences.